GST 40% Tax India 2025: Full List of Sin Goods & Luxury Items, New Rates, Effective Date, & FAQs

In News

Effective Date

New Tax Slabs

Announced By

40% Tax Slab Introduction

GST 40% Tax India 2025: Sin Goods, Super Luxury Items will Attract 40% tax (Full list of items)

GST 40% Tax India 2025: GST Tax Rate Change – The highest slab is now designed for luxury goods and non-essential items like high-end vehicles, aerated drinks and most importantly tobacco products.

Major reset in India’s indirect tax system from September 2025.

A new 40% GST slab has come into force now.

12% & 28% Brackets Removed (GST 40% Tax India 2025- New Highest Slab)

And, with it, changes the 12% & 28% brackets – which are completely removed from the GST slab.

What are New Tax Slab Brackets Now (2025)

So, for now, we just have 3 slabs – 5%, 18%, and the newly introduced 40%.

What is 40% Tax Slab For?

The highest tax slab which is 40% is designed mainly for non-essential and luxury goods. It includes:

- High-end vehicles

- Aerated drinks

- Tobacco products

Will the price for cigarettes shoot up sharply?

No, although the tax slab for cigarettes and tobacco products have risen, this doesn’t automatically mean prices will sharply shoot up. Many other factors play vital roles in deciding the MRP for sin products.

- For pan masala, gutka, and chewing tobacco – the higher rate will kick in. The main reason is the unresolved technical issues linked to pending industry loans.

What is the effective date for the new GST rates in India in 2025?

22 September, 2025 (coinciding with the first day of Navratri) – From this date, the 5 and 18 percent two-tier structure rate will be implemented.

The date was chosen after a marathon day-long GST Council meeting that was conducted in Delhi, India.

GST 40% Tax India 2025: Union Finance Minister – Nirmala Sitharaman confirmed all decisions were made unanimously. There was no disagreement from any state in the country.

We’ve reduced the slabs. There shall be only two slabs, and we are also addressing the issues of compensation cess,” finance minister Nirmala Sitharaman announced.

These reforms have been carried out with a focus on the common man. Every tax on the common man’s daily use items has gone through a rigorous review and in most cases the rates have come down drastically,” she added.

What is the ‘List of Products’ That Will Attract 40% GST: GST 40% Tax India 2025

GST 40% Tax India 2025: List of all products that will attract 40% GST from 2025 onwards.

-

Tobacco and Pan Masala (Sin Goods)

- Pan masala

- Gutka

- Chewing tobacco

- Unmanufactured tobacco and tobacco refuse (excluding leaves)

- Cigarettes

- Cigars, cheroots, cigarillos, and similar substitutes

-

Aerated and Sugary Beverages

- Carbonated drinks

- Cold drinks with sugar

- Caffeinated carbonated beverages

-

Luxury Cars

- Petrol cars with engine capacity above 1200 cc

- Diesel cars with engine capacity above 1500 cc

-

High-End Motorcycles

- Motorcycles with engine capacity above 350 cc

-

Super-Luxury Marine and Aircraft

- Yachts

- Personal aircraft, including helicopters

-

Other Sin or Luxury Items (broader category)

- Coal, lignite, peat

- Online gambling and gaming services

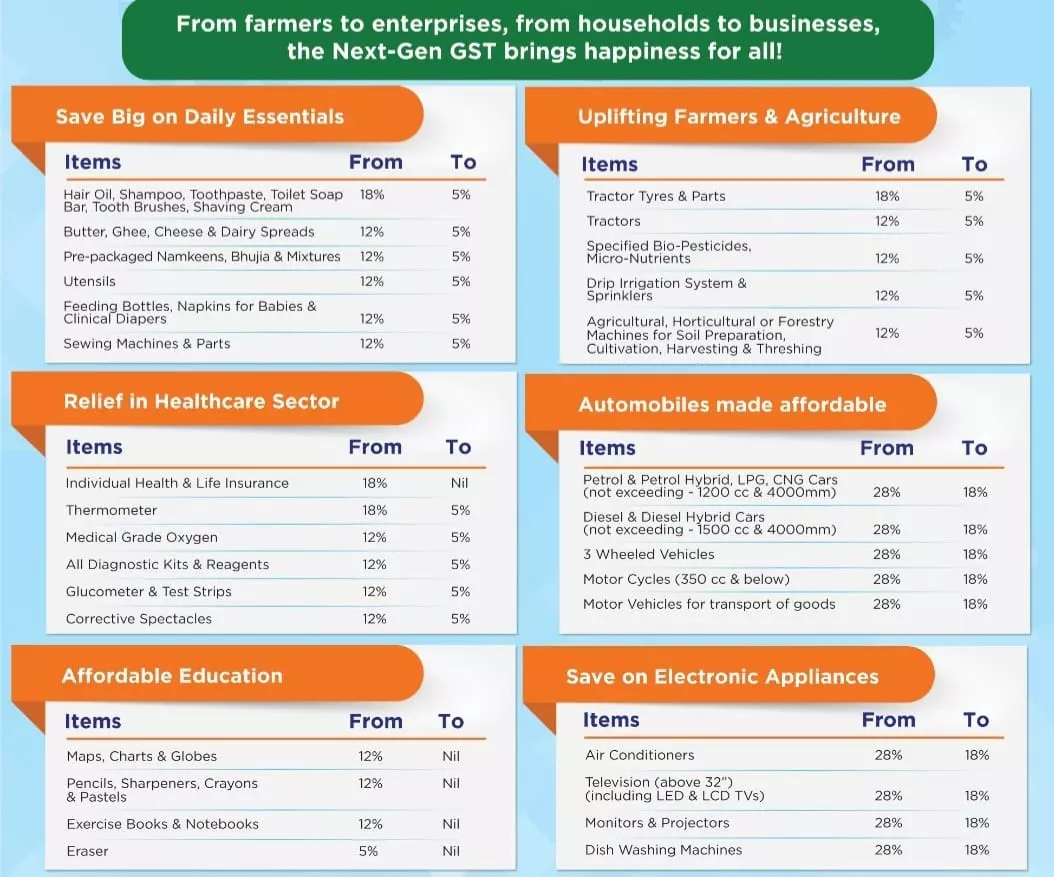

What are ‘NEW GST RATES’: Full Items List That Have Received Rate CUT (GST 40% Tax India 2025)

The GST Council has approved a two-tier rate structure in 2025. A rate structure of 5% and 18%.

Table of GST 40% Tax India 2025: Below is the full list of items and their updated/new GST rates:

| GST Rate | Category | ITEMS |

|---|---|---|

| 0% | Medicines & Insurance | Life-saving drugs, Cancer medicines, Medication for rare diseases, Individual life insurance, Health policies |

| Educational Supplies | Maps, Charts, Globes, Pencils, Sharpeners, Crayons, Pastels, Exercise Books, Notebooks, Erasers | |

| Dairy & Bakery | UHT milk, Chena or paneer (pre-packaged and labelled), Pizza bread, Khakhra, Chapathi or Roti | |

| 5% | Personal Care | Hair oil, Shampoo, Toothpaste, Toilet soap, Tooth brush, Shaving cream |

| Food & Kitchen | Butter, Ghee, Cheese & dairy spreads, Namkeens, Utensils | |

| Baby Products | Feeding bottles, Napkins for babies, Clinical diapers | |

| Medical Equipment | Thermometer, Medical grade oxygen, Diagnostic kits and reagents, Glucometer, Test strips, Corrective spectacles | |

| Agriculture & Machinery | Tractor tyres, Tractor parts, Tractors, Specified bio-pesticides, Micro-nutrients, Drip irrigation systems, Sprinklers, Soil preparation machines | |

| Sewing Equipment | Sewing machines and parts | |

| 18% | Automobiles | Petrol & Petrol Hybrid Cars (≤1200 cc & ≤4000 mm), LPG/CNG Cars, Diesel & Diesel Hybrid Cars (≤1500 cc & ≤4000 mm), 3-Wheeled Vehicles, Motorcycles (≤350 cc), Goods transport vehicles |

| Electronics & Appliances | Air Conditioners, Televisions (above 32″ including LED & LCD), Monitors, Projectors, Dish Washing Machines | |

| Heavy Vehicles | Road tractors (engine capacity more than 1800 cc) | |

| 40% | Sin & Luxury Goods | Pan masala, Cigarettes, Gutka, Chewing Tobacco, Bidis, Aerated sugary drinks, Caffeinated beverages, Non-alcoholic beverages, Smoking pipes |

| High-End Vehicles & Arms | Motorcycles (exceeding 350 cc), Aircraft for personal use, Yachts, Revolvers, Pistols | |

| Gambling & Betting | Betting, Casinos, Gambling, Horse racing, Lottery, Online money gaming |

Read the entire list of items with new GST rates & GST 40% Tax India 2025 right here – READ ME!

🧠 GST 2025 FAQ: Everything You Need to Know

Q1. When are the new GST rates coming into effect?

The revised/new GST rates will be implemented from September 22, 2025, which happens to be the first day of Navratri.

Q2. Will all items under the 40% slab be taxed from September 22?

Most items will be taxed from this date, which is 22 September 2025, but revised taxes on tobacco products like cigarettes, gutka, and beedis later due to pending compensation cess liabilities.

New GST structure has 3 slabs of 5%, 18%, and 40%— which will officially be implemented from September 22, 2025.

However, sin goods (pan masala, gutka, cigarettes, chewing tobacco, and bidis) will continue under the existing GST + compensation cess structure for now.

🧾 Wondering why?

- The loan and interest obligations tied to the compensation cess fund is still to be settled by the government.

- Once these obligations are cleared, these sin goods will transition to the 40% GST slab, then, replacing the cess-based system.

- This process will take some time, and once it is done, the exact date for this transition will be announced separately by the GST Council.

Q3. Do I need to regenerate e-way bills for goods in transit?

No. E-way bills already in transit will remain valid and doesn’t need any cancellation or re-issuance.

💸 GST Rate Structure & Changes

Q4. What are the revised/new/updated GST slabs in India?

The GST Council has simplified the structure to 5%, 18%, and a special 40% slab for sin and luxury goods.

Q5. What about the old 12% and 28% tax slabs?

12% and 28% tax slabs will no longer exist – as they are removed. Items which were previously included under 28% plus cess are now consolidated under the 40% slab.

Q6. Why is there a 40% GST rate on certain items?

The 40% rate is a special slab for high-end/premium, non-essential goods to maintain overall tax incidence after removing compensation cess. It includes luxury items and sin goods.

🚬 Sin Goods & Luxury Items

Q7. Which items will be taxed under 40% GST?

The list of the items that will be taxed under 40% GST are as follows:

- Cigarettes, gutka, chewing tobacco, bidis

- Aerated sugary drinks, caffeinated beverages

- Motorcycles above 350cc

- Luxury cars (exceeding 1200cc petrol or 1500cc diesel, and 4000mm length)

- Aircraft for personal use, yachts

- Revolvers and pistols

- Betting, casinos, gambling, horse racing, lottery, online money gaming

Q8. Will cigarettes, tobacco products and other sin goods become more expensive?

No, not immediately. Their current GST + cess structure remains until a new date is notified. The overall tax may remain similar due to cess merging.

Q9. Are IPL tickets taxed at 40%?

Yes, non-recognized sporting events like IPL will be categorised under items that attracts 40% GST. On the contrary, recognized events with ticket prices under ₹500 remain exempt.

🚗 Automobiles & Vehicles

Q10. What will be the GST rate on small cars?

GST on Small cars (petrol ≤1200cc, diesel ≤1500cc, length ≤4000mm)will be 18% GST, which was earlier 28%.

Q11. What will be the GST rate on SUVs and luxury cars?

All mid-size and large cars (which doesn’t fall in the small car definition category) will now attract 40% GST. Earlier it fell under 28% + cess structure.

Q12. What will be GST rate on motorcycles?

- Motorcycles up to 350cc: 18% GST

- Motorcycles above 350cc: 40% GST

Q13. What will be the GST Rate on commercial vehicles like trucks and ambulances?

Commercial vehicles like ambulances and trucks will now attract 18% GST, which was earlier 28%.

🧴 Essentials & Household Items

Q14. Which items from 2025 September onwards will be tax-free (0% GST)?

Tax free items will include all Life-saving medicines, individual health and life insurance, UHT milk, paneer, roti, pizza bread, maps, pencils, erasers, and notebooks.

Q15. What will be the GST rate on personal care items like shampoo and toothpaste?

Personal items will now fall under the 5% GST slab, which is reduced from previous rate of 18%.

Q16. What will be the GST rate on air conditioners and TVs?

All TVs and air conditioners will now attract 18% GST, which has reduced from 28%.

🧪 Health & Medical

Q17. What is the GST rate on medicines and medical devices?

Most medicines are taxed at 5%, and medical devices like thermometers and glucometers also fall under the 5% slab.

Q18. Are corrective spectacles and goggles taxed?

Yes, corrective spectacles and goggles will now attract 5% GST, which was earlier 12%.

🧾 Business & Compliance

Q19. What happens if I issue an invoice after the rate change but supplied goods earlier?

The time of supply will determine the applicable GST rate, based on when payment was received and when the invoice was issued.

Q20. Will Input Tax Credit (ITC) be affected by the rate change?

ITC remains valid for purchases made before the rate change, subject to standard GST provisions.

(📝 Note: This article includes AI-assisted insights to ensure accuracy and clarity).

😱More Juicy Updates 🤯

✍️ Take Your Content from ‘Basic to Brilliant‘

👗 Steal ‘Your Favorite Celebrity’s Look

💥 Bigg Boss 19 – Juicy Secrets, Drama & Shocking Updates! 👀

- Bigg Boss Season 19 Contestants List With Photos – The Celeb Bio

- Who is Vijay Vikram Singh? Voice Behind Bigg Boss!! Everything about him is right here!

- Amaal Malik Bigg Boss 19 Controversy: Did Amaal Malik Just Call Abhishek Bajaj a Naukar?

- Bigg Boss 19 Controversy: Farhana Calls Neelam & Kunnicka ‘Do Kaudi Ki Aurat’

🚨 EXCLUSIVE – Bollywood Controversies, Breaking News & Hot Updates!

- GOVINDA- SUNITA Divorce – Govinda Misses All Court Hearings

- Khushboo Patani vs Aniruddh Acharya: Controversy, Claims & What Really Happened

- Jaswinder Bhalla Death Date & Cause

- Jaswinder Bhalla Top Movies: 10 Comedy Hits that Made us Laugh

- War 2 Movie: Storyline, Cast, Release Date & Updates

- Uorfi Javed Fashion Queen: Unfiltered & Unapologetic

- Best Friends in Bollywood: Real-Life BFFs Redefining Friendship Goals!!

- Anuj Chaudhary Meets Premanand Maharaj: Anuj asked a Difficult Question.

- Mrunal Thakur Body-Shames Bipasha Basu (Calls Her Manly with Muscles)

- Ameesha Patel, Anil Sharma, Patch Up: Gadar 3 RELEASE?

🎬 EXCLUSIVE – Hollywood Controversies, Breaking News & Hot Updates!

- Who is Frank Caprio’s Wife, Joyce Caprio? The Woman who married ‘America’s Nicest Judge’ for more than 60 years

- Frank Caprio Death: 5 Things to Know About Him

- Tom Holland & Zendaya’s Indian Meal Summer Romance: Spider-Man Sets Witnessed A Lot!

- Taylor Swift’s New Album ‘The Life of a Showgirl’ Announced

🌏 Nationwide News Reports & Big Updates

- Earthquake in Assam Nagaon: A 4.3 magnitude quake jolted Nagaon on Monday

- Delhi CM Rekha Gupta assaulted during ‘Jan Sunwai’ programme.

- Earthquake in Dharamshala, Kangra (Himachal Pradesh)

- Earthquake in Assam, Nagaon: Exclusive!

- DRDO Jaisalmer Guesthouse Manager Held for Spying for ISI

🌏 International News Reports & Big Updates

- Samsung And SK Hynix Fuel KOSPI’s Upward Move

- Australia vs. South Africa – Who Won the 1st T20I Series?

- ChatGPT Down Globally! Users Frustrated

- Turkish CEO of ShiftDelete Throws Flower Pot at his Employee, Samet: Stated ‘I lost my temper‘ later.

✨🕉️ Hindu Rituals & Spiritual Insights 🙏📿

🎬 Top Bollywood Celebrity Biographies

- Jaswinder Bhalla Biography to Read in 2025

- Mahesh Keshwala Thugesh Biography!

- Hina Tasleem Biography – Age, Height, Family, Career, News, Husband, Child, Movies

- Saaniya Chandhok Biography – Fiancée of Arjun Tendulkar

🌟 Top Hollywood Celebrity Biographies

- Rema (Nigerian Singer) Biography, Wiki, Bio, Hit Songs, and More!

- Dan Bilzerian – The Hot Shot Internet Personality: Know All About His Journey

🍿 Bollywood & Hollywood Movie Updates!

🤳Trending YouTubers’ Biographies, Age, Lifestyle, Net Worth, Affairs

- Who is Rowhi Rai? Influencer & YouTuber, who went from rags to riches – Know about her age, home, family, net worth, biography, and affairs here!

- Urmila Patankar- Wiki, Bio, Height, Age, Husband, Brother, Biography, Zodiac Sign, Instagram, Hometown, Relationships, Family, Siblings, Parents, Career, Facts

- Shwetabh Gangwar-Wiki, Biography, Controversy, Height, Weight, Wife, Case, News, Hometown, Family, Book, Parents, and more

- Muddassir Khan (Yebook)- Wiki, Biography, Age, Hometown, Career, Height, Weight, Parents, Family, Siblings, YouTube, Yebook, and More

- Himanshi Tekwani (That Glam Girl)- Wiki, Bio, Height, Age, Weight, Divorce, Husband, Education, Wedding, Family, Career, Siblings, Parents, YouTube, Income, Net Worth, and Interesting Facts